Helping Fintech Founders Build Investor-Grade* Products

Building Fintech Products That Scale Fast, Impress Investors, and Conquer Global Markets.

Double Speed to MVP

Scaled Vega from $1M pre-seed to $20M Series A, team from 0→35+ engineers

Multiply Revenue Potential

Accelerating Revolut's market-making revenue and global product expansion.

Institutional-Grade Quality

Built high-performance systems for Deutsche Bank’s FX and Fixed Income desks

* Investor-grade means building products that pass due diligence, scale cleanly, and impress technical VCs.

➔ "Engagements start from £5,000. I work with ambitious fintech founders scaling fast and targeting institutional funding."

Solutions for Fintech Founders

Strategic technology advisory to accelerate funding, scale securely, and win global markets. Build an investor-grade foundation that drives growth and ensures compliance at every stage.

Investor-Grade Tech Audit™

De-risk your next funding round with a technical audit trusted by top VCs. Identify hidden risks, showcase technical strengths, and position your startup for institutional investment.

- 10-page investor-ready technical audit deck

- Technical risk mapping and mitigation blueprint

- Scalability and product-readiness recommendations

Fundraising Timeline Rescue™

Rescue critical timelines and secure your next round with fast, focused technical interventions. Fix MVP roadblocks, reduce technical debt, and hit investor milestones without delay.

- Rapid bug resolution and scalability upgrades

- Debt reduction plans aligned to growth phases

- Team mentoring for investor-grade engineering practices

Fractional CTO Advisory™

Strategic CTO partnership without the full-time commitment. Ongoing technical leadership to keep your tech, product, and fundraising in perfect sync.

- Monthly strategic planning and fundraising alignment

- Full technical roadmap creation and execution guidance

- Support on technical due diligence and investor relations

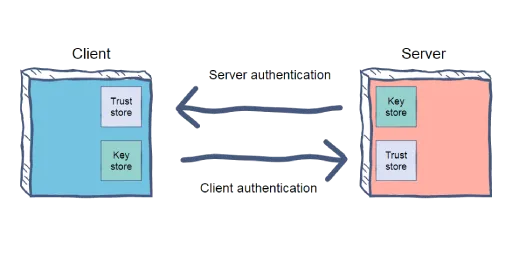

Fintech Architecture Design™

Launch secure, scalable, compliance-ready financial products. Design complex fintech architectures that can pass audits, integrate partners, and scale globally.

- Compliance-first, audit-passing architecture designs

- Scalability and security built for institutional use

- End-to-end integration strategies for fintech ecosystems

Client Success Stories

Real-world examples of how I've helped organizations solve complex technical challenges and achieve measurable business outcomes.

Client Challenge

A fintech startup needed to scale their engineering team and infrastructure to support rapid growth while maintaining high code quality and team morale.

Solution Approach

- Scaled company from pre-seed with $1M raised to $20M at Series A

- Build engineering team from 0 to 35+ engineers

- Led by example: #3 in total code contribution with 880+ commits and 455k+ sloc added

- Designed microservice architecture to manage 500B+ AUM and 10k+ clients for Apollo Asset Management

Results & Impact

View Success StoryClient Challenge

A rapidly growing fintech needed to build a scalable portfolio management system to handle increasing AUM and support global expansion.

Solution Approach

- Led the Platform Tribe of 24+ engineers across market making, market data, risk management and brokerage

- Designed and build portfolio management system handling $650M+ AUM across multiple access classes

- Architected smart order routing (SOR) in market making for hedging with <60ms roundtrip

- Supported launch of brokerage operations in Australia, Singapore, and the US

Results & Impact

View Success StorySolution Approach

- Led a team of 3 engineers to expand FX desk risk calculator to new asset class - Fixed income

- Presented the project to the multiple MDs across the organisation

- Facilitated the migration from excel based solution to web based risk calculator

- Contributed into backend development to connect multiple systems to our new platform

Results & Impact

View Success StorySolution Approach

- Managed team of 10 engineering experts in low latency and high frequency trading.

- Scaled the risk engine to support over 1M updates per second, servicing more than 400k investors.

- Created in-house derivatives platform: derivatives pricing engine, options & futures greeks calculator, IV curve builder.

- Enhanced margin trading services with 15+ overnight swaps and repos strategies.

Results & Impact

View Success StorySep 2010 - Sep 2016

Software Engineer

Multiple companies · Worldwide

Solution Approach

- Multiple backend projects in Java and C++

- Infrastructure and observability projects with on-prem and GCP cloud

- Frontend projects with Qt, Angular 1 and TypeScript

- Few voice recognition and chatbot projects with CMU Sphinx

Ready to Transform Your Business?

Let's discuss how I can help solve your technical challenges and drive measurable business outcomes.

Book a ConsultationWhat Others Say

Feedback from founders, executives, and technical leaders I've partnered with.

"Anton is a rare blend of deep fintech expertise and strategic leadership. At Deutsche Bank, he led the expansion of our FX risk platform to Fixed Income, replacing legacy systems with a scalable, high-performance risk solution. His ability to architect complex financial systems while aligning stakeholders made a lasting impact."

"Anton doesn't just build technology—he creates strategic advantages. His leadership in developing an in-house derivatives pricing engine gave us unprecedented control over margin trading, improving risk limits and significantly boosting trading volumes."

Talks & Presentations

Sharing insights and experiences through conferences, podcasts, and educational content.

Faang Talk #78

Discussion about difference between CTO in startup and engineer in FAANG

Leadership Roundtable 2024

CTO's discussion about PMF and building a high performance culture.

It's Not a Sweet B..#5

Episode #5 about Revolut and FinTech trends in product development

JavaSwag Podcast 2022

Episode #31. Many-sided fintech, MBA and transition to Product Owner

Joker Conf 2021

How to build the development process in remote-first reality?

Pouf.Conf 2019

Big Bank, Big IT. How to build live risk systems from scratch

Hydra Conf 2019

Living in a cross-language project. Java between React and C++

HighLoad Siberia 2019

Why do we do have quick FX risk calculations in the bank.

Scale Smarter. Raise Faster. Build Stronger.

Book a free strategy call to align your tech with your funding and growth goals. Technical advisory or fractional CTO support — tailored to fintech founders.

Quick Start Options

Choose the fastest path to connect and move forward.

Tell Me About Your Startup

Share your challenges and goals, and I'll create a tailored solution for you.